Exciting Actors in the Capital Access Space

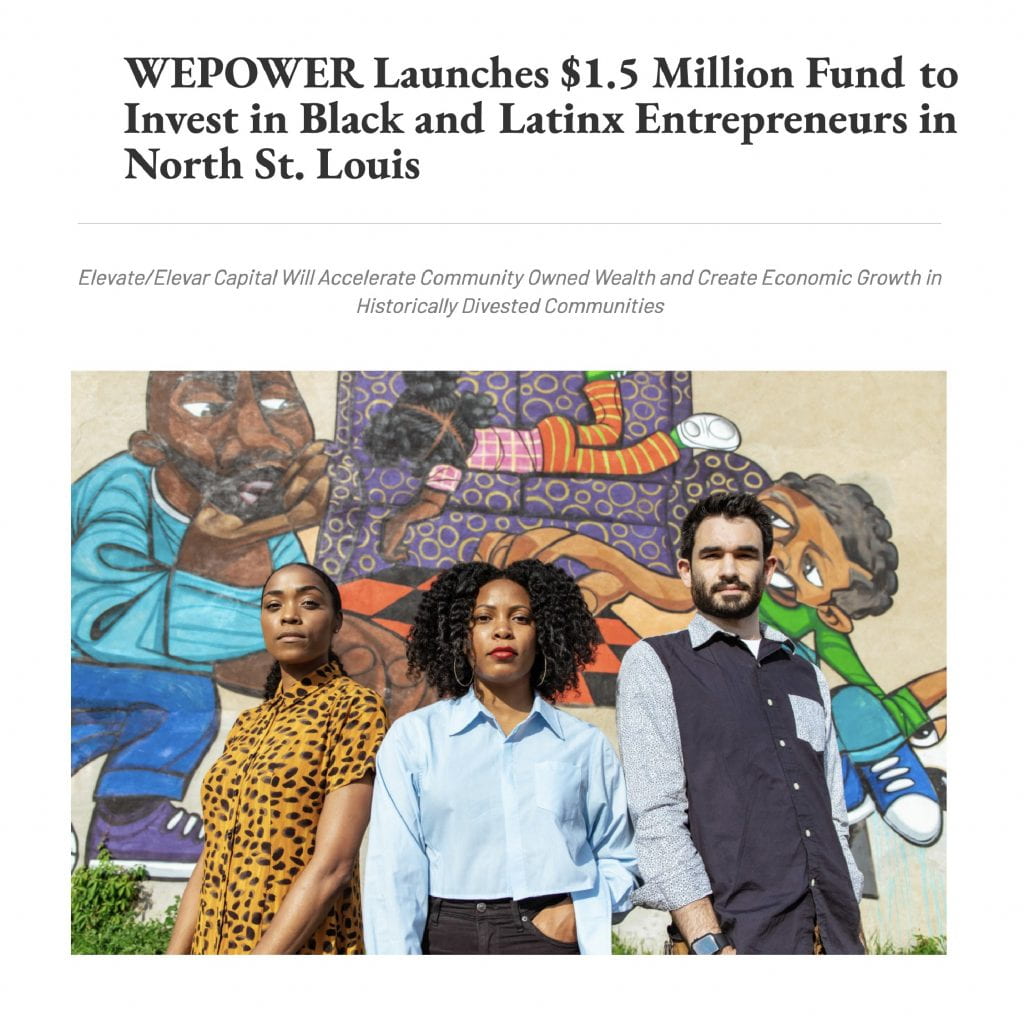

1. WEPOWER (St. Louis)

One of the first funds of its kind, Elevate/Elevar Capital targets companies owned by Black and Latinx entrepreneurs with a strong growth trajectory in North St. Louis. It keeps ownership and control in the hands of entrepreneurs versus equity in exchange for investment. Through this fund, capital is made more accessible by using a holistic approach to underwriting and eliminating common barriers, such as collateral requirements and minimum credit score thresholds. The organization also ensures business owners commit to hiring in areas that have experienced generational disinvestment and providing people with living wages. They also utilize a revenue-based repayment structure rather than relying on traditional fixed installments.

Email: info@wepowerstl.org

Phone Number: (314) 391-8033

2. ICA (Bay Area)

In 2019, ICA served 143 companies, our accelerator and investment portfolio companies employed 547 workers, 75% of our companies are led by entrepreneurs of color and/or women entrepreneurs. ICA companies grew revenues by 22% over 2018. ICA companies raised $17.3MM in outside investment capital. ICA investment portfolio companies have grown in value by $76.3MM.

Email: info@ica.fund

Phone: (510) 271-0142

3. Mission Driven Finance

Their flagship people- and place-based fund, Advance is an evergreen revolving private credit portfolio in San Diego. Advance provides debt financing up to $500,000 to tenacious small businesses, social enterprises, and nonprofits that are committed to advancing local economic opportunity.

Their Employee Ownership Catalyst Fund supports businesses throughout the U.S. that want to transition to employee ownership and need capital to do so. It provides up to $500,000 in financing structure tailored to each business: loans, revenue-based financing, or equity. Operated in partnership with Project Equity, the fund promotes resilient, quality jobs, increases worker voice, and preserves and strengthens small business assets in communities.

Their National loan program supporting people on the move finance U.S.-based businesses and organizations that actively support people on the move—immigrants, refugees, asylees, low-income economic migrants, and survivors of trafficking. It provides $50,000 to $250,000 with a 6% interest rate with 6-month to 4-year terms.

MDF is entirely focused on private market impact transactions and asset management. It has customized structures with revenue-based financing for flexible payment schedules and Islamic financing. Further, it is designed to expand access to capital, with no need for personal credit scores or personal guarantees.

Email: info@missiondrivenfinance.com

Phone: (858) 880-0252

4. Boston Ujima Project (Boston)

The Boston Ujima Project build with the contemporary reconstruction movements happening across the U.S. to collaboratively (re)shape a sustainable future, delinked from extractive economies and racialized exploitation.

The Ujima Good Business Alliance (UGBA) unites local businesses, provides multi-faceted support, and incentivizes accountability to shared values. The UGBA is a network of community-based businesses that are eligible for investment from the Ujima Fund and other supportive programs.

Email: info@ujimaboston.com

5. Seed Commons

Seed Commons takes in investment as a single fund, then shares that capital for local deployment by and for communities, lowering risk while increasing impact. Seed Commons also shares backend services and a comprehensive, peer-based learning system to give each member the tools necessary to succeed accessing capital like market players, yet deploying it using local community relationships.

The funds in the Seed Commons cooperative provide financing for cooperatively owned and community-controlled enterprises around the country. Read about the principles used to drive lending, and if your project qualifies, see if there is a fund in your region!

6. RUNWAY

Runway Offers Flexible & Friendly capital for early stage and growing businesses, a tight-knit network of peer Black businesses in the Bay Area and Massachusetts, weekly one-on-one business advising, bi-monthly peer business coaching, and access to expansive funding & resource networks.

Runway prioritize African-American from all industries and do not rely on traditional bank requirements such as credit score, or past business performance. Instead they focus deeply on your business model and plan, financial projections, your passion, relationships in the community, and dreams for the future.

7. 1863 Ventures (Washington DC)

Over the past several years, 1863 Ventures has worked with over 2,500 early-stage and growth-stage founders through their formal programs across a multitude of sectors and industries. With a membership representing nearly $300M and several thousand jobs, 1863 have crossed paths with some of the best and brightest founders in the nation.

Email: info@1863ventures.net

8. Founders First Capital Partners

Founders First Capital Partners focus on funding and growing service-based companies generating $500,000 to $10 million in annual revenues. Over 80% of their investments are to company’s led by diverse founders including people of color, women, LGBTQ+ and military veterans.

Website: https://foundersfirstcapitalpartners.com/

Email: info@f1stcp.com

Phone: (858) 264-4102

9. Greater Colorado Venture Fund (Colorado)

10. Cutting Edge Capital

They seek to work with clients and to use vendors who meet these criteria;

Local and/or Community Ownership — the client or vendor is privately or worker-owned with a majority of the owners actively participating in the company, or is wholly or partly community owned or funded.

Authenticity — the vendor’s or client’s values and mission are aligned with CEC’s mission and focus, including a commitment to inclusiveness and diversity.

Social Responsibility — the vendor or client’s social and financial practices and policies are designed to ensure optimal benefit to their employees, to the local community and the local economy.

Environmental Stewardship — the vendor or client’s environmental practices, policies, services and products are designed to minimize environmental impact and resource use, and thereby minimize the extractive nature of their operations.

Email: info@cuttingedgecapital.com

Phone: (510) 834-4530